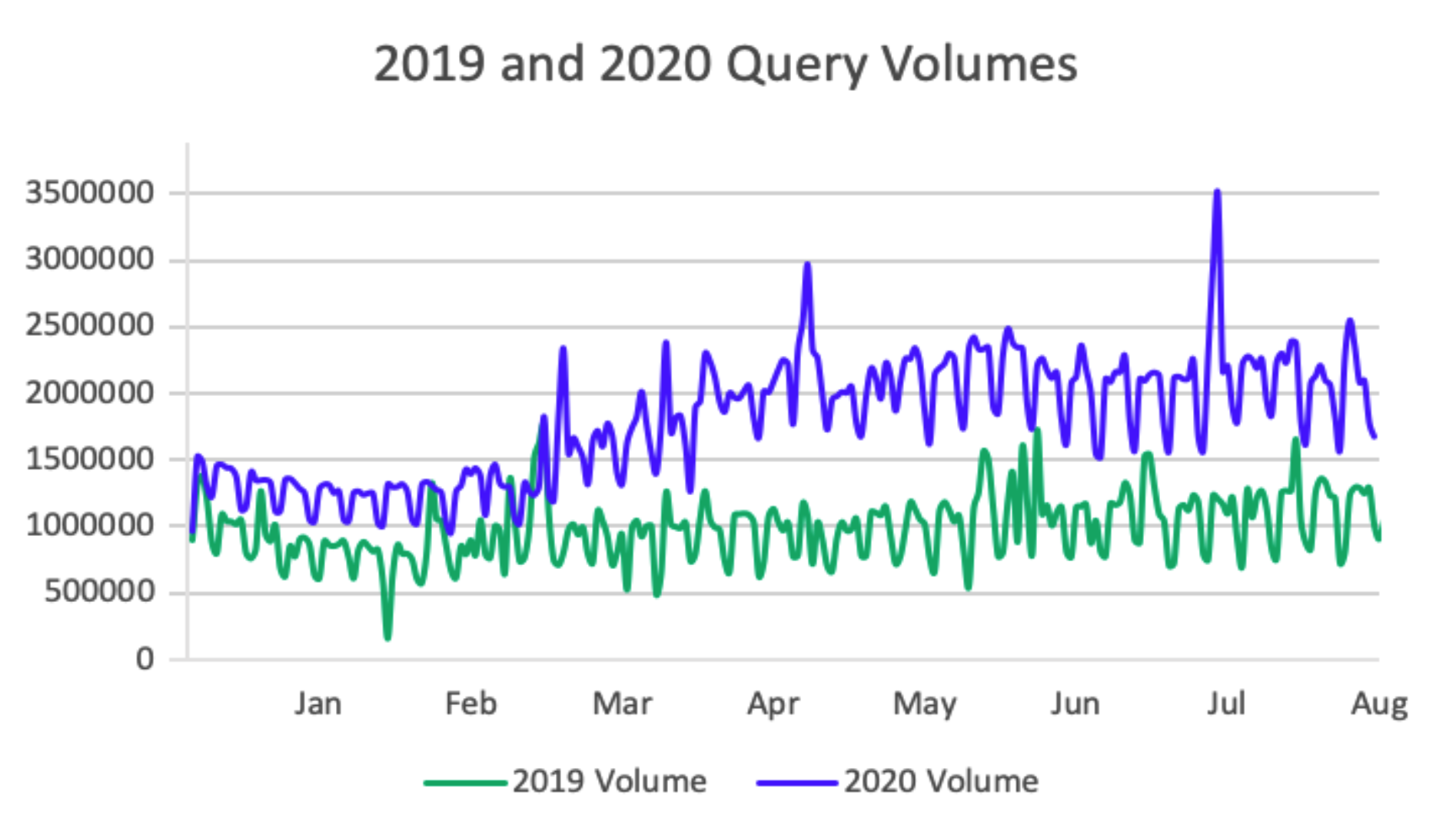

There’s no doubt about it. COVID – 19 has forced an evolution in eCommerce. When you examine the patterns and trends of online transactions globally since the pandemic was first declared (and you better believe we have examined it!) it’s extraordinary. While January through March 2020 matched forecasted volume increase over the same period in 2019, come March 16, the increase – again, across the globe – is a sight to see.

Of course, a global economic response to a global pandemic, even when unprecedented, is to be expected. But what can we expect will be the effects of COVD-19 on Black Friday? Before we dig in, it’s important to appreciate that Black Friday, traditionally the biggest shopping day of the year in the U.S, has extended to become an international shopping event. For example, in the UK, while the big winter sales have traditionally been held the day after Christmas, companies have adopted the Black Friday marketing campaigns since 2010. Meanwhile, Black Friday momentum has been growing steadily in Europe since 2014, from an obscure shopping holiday to one of the biggest retail days of the year. Throw in China’s Single’s Day, and we’ve got ourselves a global phenomenon of spending every November through to the end of the year.

Enter 2020.

As Noelle Wiggins, Ekata’s Data Acquisitions Manager explains, “Because Black Friday is today considered a global phenomenon, it is comparable to COVID-19 – a single, broadscale event that moves the entire global economy. One is unprecedented. One is planned.”

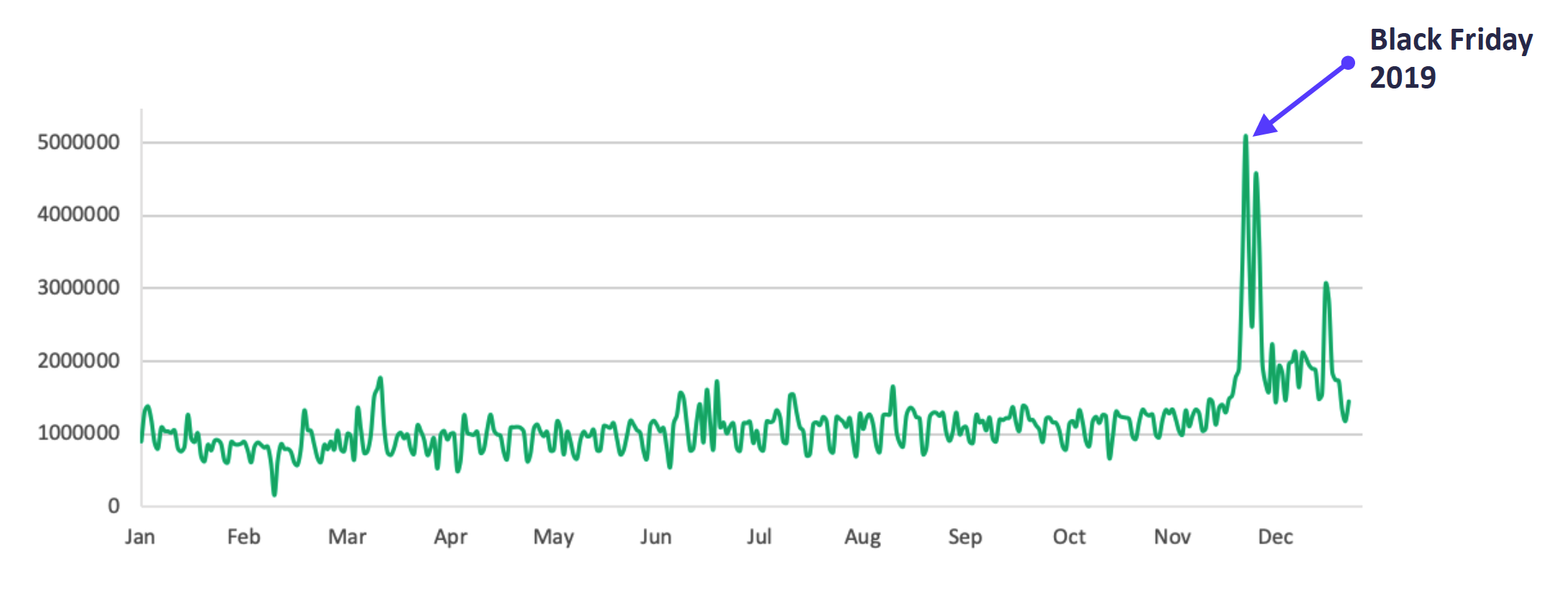

Historically, it’s always been a straightforward process to predict an upcoming sales year; Black Friday kicks off a spike in volume that levels out at the end of November but stays elevated relative to the rest of the year. Indeed, the three-day period between November 27 and November 29, 2019, saw a 167% increase in transaction volume.

So, the question is: Will Black Friday follow its historical trend?

In the past, Black Friday has grown approximately 15-20% year over year, with last year being most significant at 17% growth digitally from 2018. This is critical information, reminds Wiggins in our latest webinar on Preparing for Black Friday during COVID-10.

“When we are looking into how we are going to adjust our fraud models, how we are going to prepare our manual review agents, what we are going to look at in regards to our (Ekata’s) confidence score and modeling and risk analysis, that transaction volume is really important to know. It has an effect on how we (respond to) fraud.”

During the webinar, we asked our audience what growth if any, they expect this year in Black Friday transaction volume over last year. Here were the options that were given:

SIGNIFICANT – Greater than 20% growth over 2019

MODERATE – 10-20% growth over 2019

MODEST – Less than 10% over 2019

NONE – No growth over 20%

The results came in hard and fast:

38% expect a significant growth

50% expect a moderate growth

6% expect modest growth

6% expect no growth

Now, despite modest numbers predicting modest growth, we also are thinking along these lines (come back to us in December and let’s see who is right!).

Here are three major contributing factors to what we believe will be a smaller Black Friday peak:

1. Sales are moving forward

Forget past years when you were still digesting pumpkin pie and cranberry sauce when you hit the shops. The reality this year is that Black Friday sales will be kicking off online in early October as retailers seek to seduce cautious consumers ahead of the U.S election in November.

Retailers are further spurred on to heavily discount earlier to make up for such an affected year in retail due to shutdowns.

2. Major retailers staying closed

Are those images of shoppers camping out the front of stores to get the first shot of season deals a thing of the past? What about the fisticuffs over a 56-inch flat screen TV? Walmart paved the way as the first to announce that it would not open its physical doors during Thanksgiving 2020 and other heavyweight retailers, including Target, Home Depot, Kohls, Best Buy, and Dick’s Sporting Goods, quickly followed suit.

Some stores will stay open but are promising restrictions will be in place to keep shoppers safe; curbside pickup, parking lot pop-ups, scheduled in-person visits, and more hand sanitizer than you can poke a socially-distanced stick at!

3. Consumers have less to spend

It’s simple really. If you think about a person’s economic situation as a zero-sum game, then the same amount of money someone may spend in a year that was historically backloaded to Black Friday has now been frontloaded to the second and third quarters of the year. This means that not only have they been spending more money throughout the year, but they have specifically less to spend come holiday sales.

And let’s not pretend the global economy isn’t in a serious shake-up. In its June 2020 Global Economic Prospects report, the World Bank forecasted the global economy will shrink by 5.2%, representing the deepest recession since the Second World War. That’s sure to dampen consumer spending.

Of course, it’s not all hopeless. In a year that promises anything but certainty, there is one thing we are sure of: Consumers will come out winning. Those with pennies up their sleeve can count on extra big savings without the extra-long lines. But the stakes are higher than ever for retailers. More than a dozen major retailers have already filed for bankruptcy during the pandemic and many others are at risk of running out of cash if sales don’t pick up soon. Clever marketing and a strategy that emphasizes online deals will be paramount; as will a robust online server capacity. Retailers must think outside the box, both literally and figuratively.

So, there you have it. With increased spending across the year, little to no experiential or economic impetus to spend on a specific day, and a global recession to contend with, we predict the growth of less than 10% this Black Friday over 2019.