Fast, accurate payment authentication can raise growth potential and reduce fraud

What is payment authentication?

The payment authentication process validates the identity and legitimacy of a payment transaction. This ensures the person or business initiating the payment is the authorized account/card holder. Payment authentication can protect merchants from fraud and chargeback abuse.

Who needs payment authentication?

Anyone who wants to protect their business from the global payment fraud industry needs payment authentication; specifically, merchants seeking relief from chargebacks and payment acquirers and processors whose business is ensuring a safe and secure financial environment for their customers.

Why do you need to optimize payment authentication?

Optimize your payment authentication process by evaluating transaction risk in real-time before authorization takes place. This reduces friction for your good customers and maximizes conversion rates by assessing transaction risk earlier in the workflow through payment provider relationships.

How to optimize payment authentication

Pre-authorization risk assessment

Evaluate transaction risk before authorization to make informed decisions that drive higher authorization rates earlier in the process.

Fraud management

By integrating data into the platform, you build a stronger and more strategic fraud management system for your merchants.

The solution

To determine potential fraud risk, it’s important to know who your customers are by evaluating how their digital information has been used.

Tracking these elements throughout the payments environment can enhance information sharing and build beneficial relationships between processors and merchants across the ecosystem.

Transaction Risk API

Maximize approval rates while fighting transaction fraud.

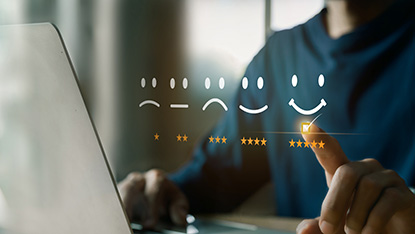

Improve the customer experience

Reduce friction and associated cart abandonment throughout the transaction, from checkout to payment authorization.

Improve authorization rates

Maximize conversion rates through payment provider relationships and assessment of transaction risk.

Differentiate with third-party data

Acquiring processors can help merchants evaluate riskier transactions and normalize data formats for sharing.

Resources

Success story

Karta and Mastercard Identity: Giving the gift of seamless payment workflows

Blog

Measure transaction risk with Identity Risk Scores

CONTACT AN EXPERt

Contact us to find out how Mastercard Identity solutions can help authenticate more transactions.