Payment fraud — an assault on customer trust, a financial burden to businesses

What is payment fraud?

Payment fraud usually involves a bad actor stealing someone’s identity data and using it to make fraudulent transactions. When the victim becomes aware of the unauthorized purchase they usually seek remedy through their bank with a card cancellation/reissue and the initiation of a chargeback.

Payment fraud can also occur when a customer makes a purchase they don’t recognize and calls their bank to initiate a chargeback. This “first party” fraud can be intentional when a consumer initiates a chargeback after claiming not to receive goods they knowingly have.

How does payment fraud affect the parties involved?

For consumers, the aftermath of payment fraud can feel disorienting and stressful. Adding insult to injury, cancelling and requesting new cards is time consuming.

Payment fraud can inflict severe financial hardship on businesses by the time you factor in the cost of lost merchandise, shipping and the chargeback with potential fines, fees and reputational damage.

Benefits of the right payment fraud protection

By identifying fraud early in the transaction, you can prevent it early. This will save your business the cost of lost merchandise, the lost transaction and the potential chargeback with associated fees. This also safeguards against legal, regulatory and reputational damage. The right protection also strikes the proper balance between managing fraud and first-party fraud, delivering a frictionless customer experience and long-term customer value.

Transaction fraud hot spots

Pre-authorization

Prior to processing the payment for authorization, fraud can be flagged while in the shopping cart and still very early in the transaction flow.

The transaction workflow

As part of the transaction workflow process, rejected transactions can be reassessed for true fraud or a wrongfully declined good customer.

Manual review

In the later stage of the workflow, during post-authorization, questionable transactions can be flagged and sent for manual review.

The payment fraud solution

By catching fraud early in the payment process, you can save the cost of lost merchandise, a lost transaction and reduce the fees and losses associated with chargebacks.

Transaction Risk API delivers an actionable signal that quickly reveals the probability of fraud at enterprise-levels with negligible friction.

Transaction Risk API

Maximize approval rates while strategically managing payment fraud.

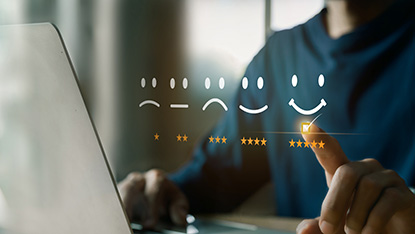

Improve the customer experience

Reduce friction throughout the transaction for verified customers, from checkout to payment authorization.

Improve authorization rates

Maximize conversion rates by using payment provider relationships and assessing transaction risk.

Differentiate using third-party data

Acquiring processors can help merchants evaluate transaction risk and normalize data formats for sharing.

Resources

Blog

Card testing fraud explained: How merchants can respond

Report

Facilitating trust, driving growth and providing great customer experiences

CONTACT AN EXPERt

See how Mastercard Identity can reduce fraud risk for your business.