Elevate your manual fraud review capabilities and efficacy

What is manual review?

A traditional manual review is the reviewing of information by a human, as opposed to AI/machine learning, to confirm fraud has not occurred. This human reviewer, often a fraud analyst, is trained to review all available data points and reach a data-driven decision.

How do manual reviews prevent fraud?

Manual reviews are an important step in risk management as human insights can help bring clarification and improved precision by reading between the lines and providing nuance in ways software cannot.

How does a manual review solution assist in reviews?

Because unassisted manual reviews rely solely on subjective human interpretations, they can be just as error prone as the most rigid of rule sets. Additionally, traditional manual reviews are time consuming, costly and lack scalability, a review solution speeds up the process and works at global scale.

For these reasons, a manual review is most effective when optimized with a manual review solution. This will not only improve customer satisfaction, enabling agents to confidently approve more good customers faster, reduce chargebacks and abandonment, but also increase overall productivity by arming agents with logical precision in identifying fraud.

When to use a manual review solution

Identities are manually reviewed

A manual review agent steps in to investigate, reviewing identity elements behind the transaction.

Review queues fill up

When there is no clear decision on the legitimacy of a transaction review queues fill up.

Fraud is determined manually

The manual review agent makes a decision on whether or not the fraud has occurred.

The solution

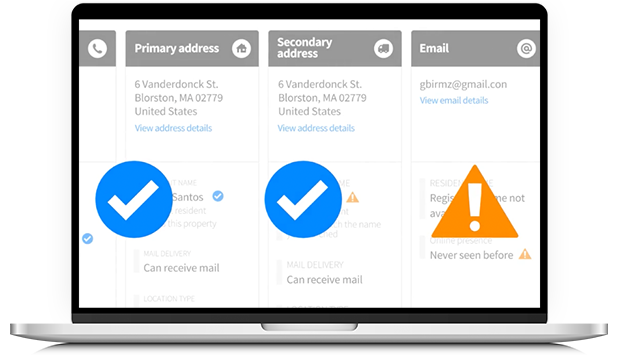

Identity Review 360 is the only global identity review solution that provides six ways to search, with robust analytics and admin tools, direct workflow integrations and a clear focused user experience.

This enables organizations to quickly assess identity risk, approve good transactions, investigate fraud on a global scale and keep review queues moving.

Identity Review 360

A manual review SaaS tool to approve or deny transactions quickly and confidently.

Improved customer satisfaction

Allow agents to see customer data and the linkages between elements to quickly and confidently approve more good customers.

Increased agent productivity

Save substantial search time and enable agents to approve good orders quickly through our single-search capability.

Fight fraudulent orders

Use our machine learning-powered network that adapts to fraud patterns and arms agents with evolving insights to identify fraud.

Resources

CASE STUDY

GoPro tackles peak season fraud to reduce the number of falsely declined customers

CASE STUDY

How to conduct an identity review in a single click

CONTACT AN EXPERt

See how Mastercard Identity can optimize your manual review process.