When the COVID-19 outbreak was first declared a global pandemic by the World Health Organization (WHO) in mid-March, nobody was in a position to predict just how great an impact this would have. After an initially fragmented response, a truly global response was underway.

The announcement of the closure of non-essential retailers around the world sparked an unprecedented surge in online shopping. Suddenly, many employees were forced to log into their organization’s system remotely, relying on their WiFi connections at home. Meanwhile, e-Commerce was up 25% by mid-March compared with end-February as folks were encouraged to shop online, some for the first time ever. Come April, U.S consumer spending on Amazon alone increased by 35%, compared with the same period in the previous year.

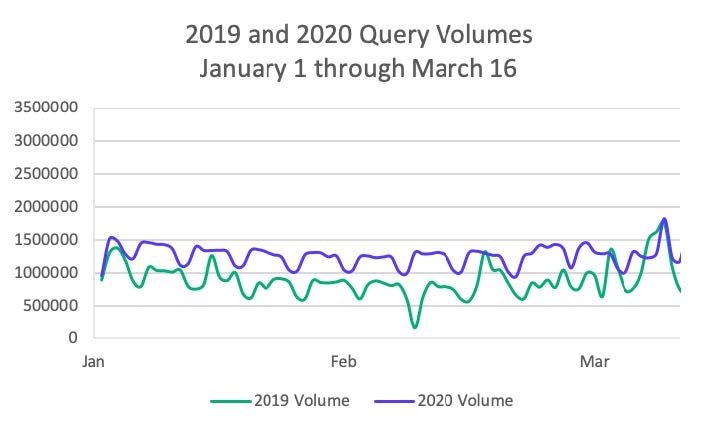

Over the past eight months we have been diligently observing Ekata’s global network, and we have seen some truly fascinating online volume trends. Before we dig in, it’s important to know that when we talk about volume, what we are talking about is the number of transactions and queries that come through our system each and every day. As you can see in the graph below, query volumes from January 1 through to March 16 2020 matched forecasted volume increase over the same period in 2019.

Of course, enter a viral pandemic, and sweeping behavior change is soon to follow. As Noelle Wiggins, Ekata’s Data Acquisitions Manager explains,

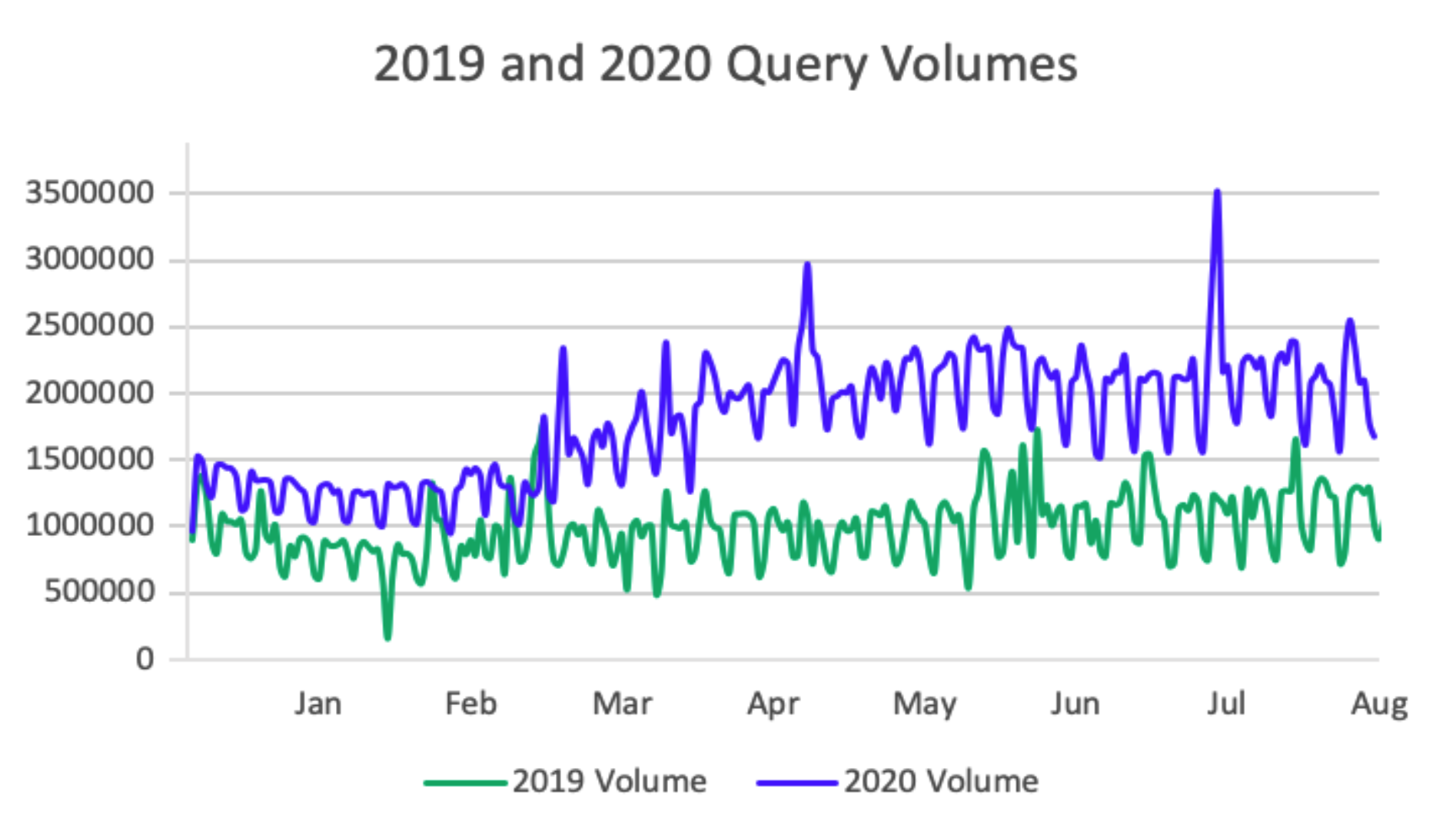

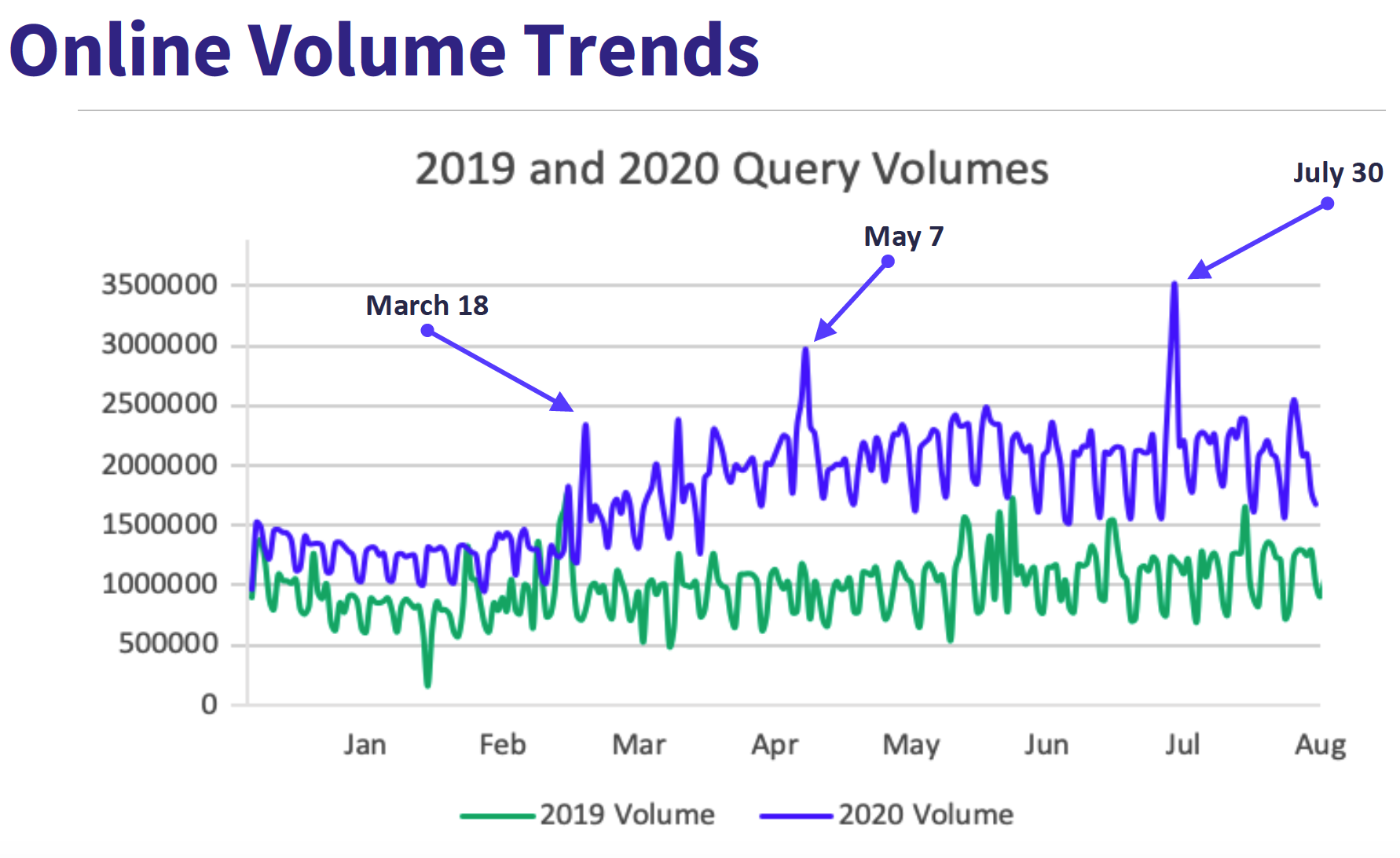

“The increase in volume is massive. (Moreover,) when we look at Ekata’s query volume from a global perspective, we never expect to see the entire global economy moving in the same direction. Sure you have localized, regionalized events. But, this global trend is just not normal.”

Of course, what this immediately illustrates is what a truly global response we saw in response to COVID-19. But we also caught a glimpse into how the global digital economy is changing.

One of the biggest changes is for small companies – those mom and pop shops that dot the Main Streets of the globe – attempting to keep up with the new digital reality. According to recent research conducted amid the lock downs by PYMNTS, as many as 85%, 84% and 80% of consumers have shifted to digital for shopping for groceries, retail products, and food from restaurants.

While the pandemic has upended the way smaller businesses must approach sales and strategy in order to find new customers, the greatest digital shift also demands that payments be a seamless part of the B2B interactions between buyers and suppliers.

Indeed, when you can no longer see your regular customers, how can you trust that the payment details provided are not fraudulent? This is where Ekata comes in. Enabling secure connectivity for digital ecosystem participants to exchange payment information seamlessly is paramount to staying in business. But let’s get back to our data at hand…

When we return to our graph (please note, this graph has been normalized and smoothed), we see the initial peak at around March 18, 2020. This is not surprising – a week earlier, the pandemic had been declared and a global response had kicked in. The first major wave of lock downs were underway, with France, Spain and Italy leading the charge, while Australia and the United States implemented strong travel restrictions and quarantine policies. In fact, despite the slightly varying response in this first week across Asia, Europe and North America, it all seems to have averaged out to normal volumes globally.

The next big peak is May 7, 2020. This was the week most major economies rolled out significant relief and stimulus packages. It was also the moment in the lock down narrative when some countries started discussing easing up on shutdowns, despite an increase in death tolls.

Of course, low and behold, come end of July we peak as the infection rate increases and discussions begin anew for a second lock down.

“This unusual increase (July 30) in the amount of queries coming through to Ekata – 189% more than what we saw at this time last year – is not normal. The only times we see such significant peaks in spending are around the traditionally big spending holidays, like Black Friday. We have never before seen this globally.”

To learn more about how COVID-19 will impact Black Friday Sales this year, read our blog post, Data Deep Dive, Part I COVID-19’s Estimated Effect on Holiday Shopping Trends.

To hear more from Noelle Wiggins and our incredible data acquisitions team on the effect COVID-19 has had on the global economy, watch our webinar.